The 5 Nonprofit Business Models Revealed: A Nonprofit Financial Leader’s Guide – Webinar Recording and Resources List

This, finally, is the intensive but practical course you were never offered in your training for nonprofit financial leadership—you do not want to miss it!

Webinar Recording: 5 Nonprofit Business Models Revealed

This video is an in-depth introduction to a set of six seminars based on grounded research (or on-the-ground study over time) of the diverse and distinctive financial dynamics of different types of nonprofits. What drives, disrupts, and needs to be measured and monitored to optimize your organization’s financial outcomes, as compared to performing arts or foster care operations? What do you have to consider when diversifying or shifting a revenue source? These seminars will provide a valuable framework to help nonprofit leaders smooth out any periodically turbulent operations and strategically advance their organization’s financial positions.

Nonprofit Financial Commons. February 7, 2023. “5 Nonprofit Business Models Revealed.” Webinar Recording

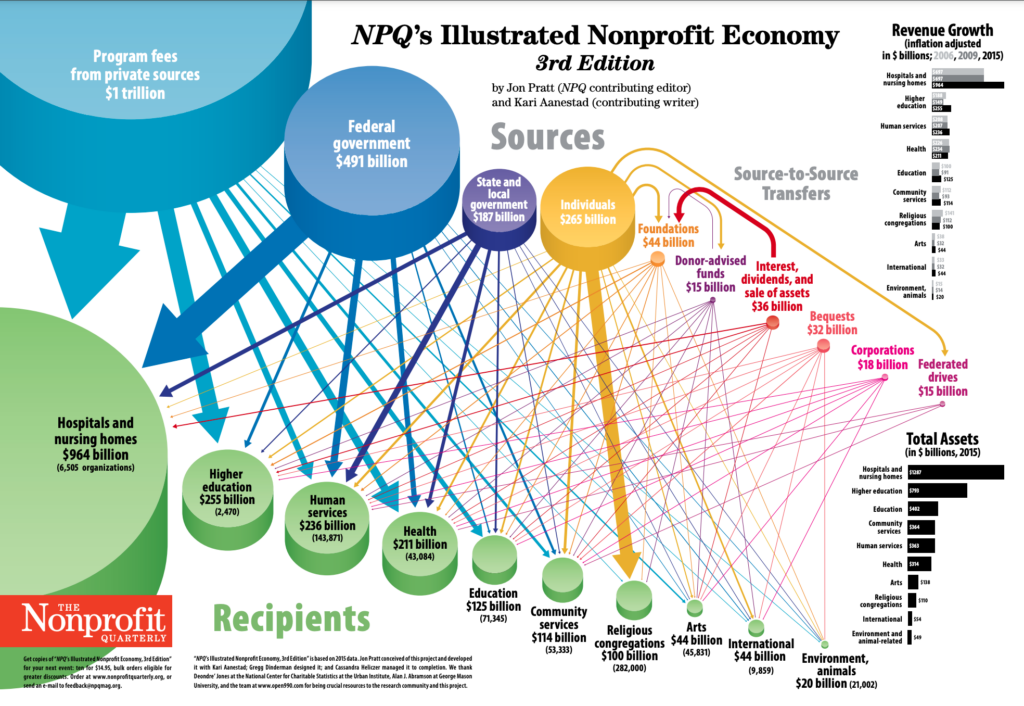

This nonprofit economy map portrays the revenue flows of the sector that go to US charitable nonprofits, organizations recognized by the IRS as tax exempt under 501(c)(3).

Map of the Nonprofit Economy

Resource Library: Tools and Articles

This video, “Everyone Deserves a Fair Slice” does a great job illustrating the challenges that nonprofit organizations face with the current nonprofit funding model by state governments and private funders.

Human Services Council. December 11, 2018. “Everyone Deserves A Fair Slice.” [Video]. YouTube.

Readings

In, But Not Of, The Market: The Special Challenge of Nonprofitness. Lester Salamon and Ruth McCambridge on the dynamics and effects of the fact that nonprofits function in “muted markets” – that is that most nonprofits run on revenue that is provided by a third party rather than the direct beneficiary. (Nonprofit Quarterly; March 21, 2003)

A peek inside: Deeper questions exist. Whose interests are served by a specific response to a social problem? The truth is that the worldview of those paying for a particular response may have very little in common with that of the users. The buyer and user may, in fact, have almost entirely different worldviews.

The Looking-Glass World of Nonprofit Money: Managing in For-Profits’ Shadow Universe. A classic article by Clara Miller looking at some of the perverse ways money works in nonprofits. (Nonprofit Quarterly; June 12, 2017)

A peek inside: Rule #3: Cash is liquid. True or false? For the lion’s share of many nonprofits’ revenue, the answer is false. When is cash not liquid? When it’s restricted cash! As a good manager in the nonprofit economy, you bring in revenue from direct customers, donors, foundations—a large group of interested “buyers.” These buyers often restrict their purchases and gifts to specific purposes—teacher’s salaries, for example, or books. It’s understandable: this gives your donors a direct, defined connection between their funds and the program. Nevertheless, by nonprofit accounting rules, the restricted cash must then sit in the bank until you go out and buy the item or perform the service its purchaser or donor prescribes. Let’s say your donor restricts the cash donation to replacement mattresses for your homeless shelter. If there’s a plumbing crisis, or you decide to add maintenance staff, you can’t touch that cash. Even if you have cash in the bank, you’re going to need another source of payment, fast. This creates the impression among some that a nonprofit is solvent—flush, even—when it’s actually in a cash crisis.

Ten Nonprofit Funding Models. This article is a different take on nonprofit business models and is worth a read in terms of identifying both the variables and dynamics of 10 different types of models. (William Landes Foster, Peter Kim, Barbara Christiansen. Stanford Social Innovation Review; Spring 2009)

A peek inside: In the current economic climate it is tempting for nonprofit leaders to seek money wherever they can find it, causing some nonprofits to veer off course. That would be a mistake. During tough times it is more important than ever for nonprofit leaders to examine their funding strategy closely and to be disciplined about the way that they raise money. We hope that this article provides a framework for nonprofit leaders to do just that.

Nerd Corner

A Bourdieusian Perspective on the Business Model: Exploring the Virtuous Circle of Societal Value Creation and Capture by Nonprofit Organizations. This article does an amazing job of describing how social capital is converted to financial capital in the nonprofit sector. It uses detailed real life examples that makes the process of accumulating and converting different kinds of capital into success very understandable. (Gaëlle Cotterlaz-Rannard and Michel Ferrary. GSEM, University of Geneva. Association Francophone de Gestion des Ressources Humaines; October 2021)

A peek inside: Our paper aims at addressing the theoretical gap on the NPO business model. It presents and develops a theoretical framework to explore and improve upon the business model of NPOs using Bourdieu’s theory of forms of capital. Such perspective provides a paradigm shift from conventional literature on business models. This theory incorporates other capitals (cultural, social and symbolic) beyond the economic one and describes the importance of accumulation and conversion of capital to support an organization. By exploring societal value as the ultimate goal of NPOs, and not as a means to increase economic value, we analyze the mechanisms underlying the societal value creation and capture underlying the NPO business model.

The Role of Nonprofit Enterprise. This is a classic by Henry Hansmann that describes the “non-distribution constraint” that is the core differentiator between nonprofit and for profit financial practice and is the foundation that underlies many of our structures and regulations. (Yale Law Journal; April 1980)

“A nonprofit organization is, in essence, an organization that is barred from distributing its net earnings, if any, to individuals who exercise control over it, such as members, officers, directors, or trustees. By ‘net earnings,’ I mean here pure profits-that is, earnings in excess of the amount needed to pay for services rendered to the organization; in general, a nonprofit is free to pay reasonable compensation to any person for labor or capital that he provides, whether or not that person exercises some control over the organization. It should be noted that a nonprofit organization is not barred from earning a profit. Many nonprofits in fact consistently show an annual accounting surplus. It is only the distribution of the profits that is prohibited.” Net earnings, if any, must be retained and devoted in their entirety to financing further production of the services that the organization was formed to provide.

Participant Share

Nonprofit Financial Commons is an interactive community. We are interested in hearing from you. I encourage you to share your resource link and an annotation about how it might help others.