Financial Risk Assessment: A 3-Level Model for Nonprofits in 2025

By Hilda Polanco and Sarah Walker

This is the third in a series of articles responding to the 2025 turbulence in the nonprofit financial revenue landscape.

EXCLUSIVE TO THE NONPROFIT FINANCIAL COMMONS — MAY 2025

As many nonprofit organizations continue to navigate uncertainty, there is an immediate need for leaders to assess their risks and consider how they may respond to likely scenarios. The following risk assessment model is designed to guide nonprofit board of directors and management staff on the work they need to do to organize their financial planning over the next six months to a year.

This framework should serve as a “gut check” on the degree of potential impact the current economic and political environment may have on a nonprofit’s revenue streams and financial health. Instead of requiring exhaustive data inputs, the tool creates a common understanding from which to take action.

Determining Your Financial Risk Profile

It is essential for a nonprofit leader to have a clear understanding of their organization’s business model and the strength of the balance sheet, particularly the availability of operating reserves and cash on hand. Leaders must also understand which funding sources are restricted and any limitations to make budgetary changes.

To assess your organization’s financial risk profile, ask yourself the following questions:

- What are our key revenue drivers?

- Which funding sources are likely to be affected?

- Are revenue decreases anticipated to be minimal, moderate, or severe?

- Are our mission and service areas politically controversial? If so, how might they be at risk?

- If revenue dips, what financial reserves can we draw on to sustain operations?

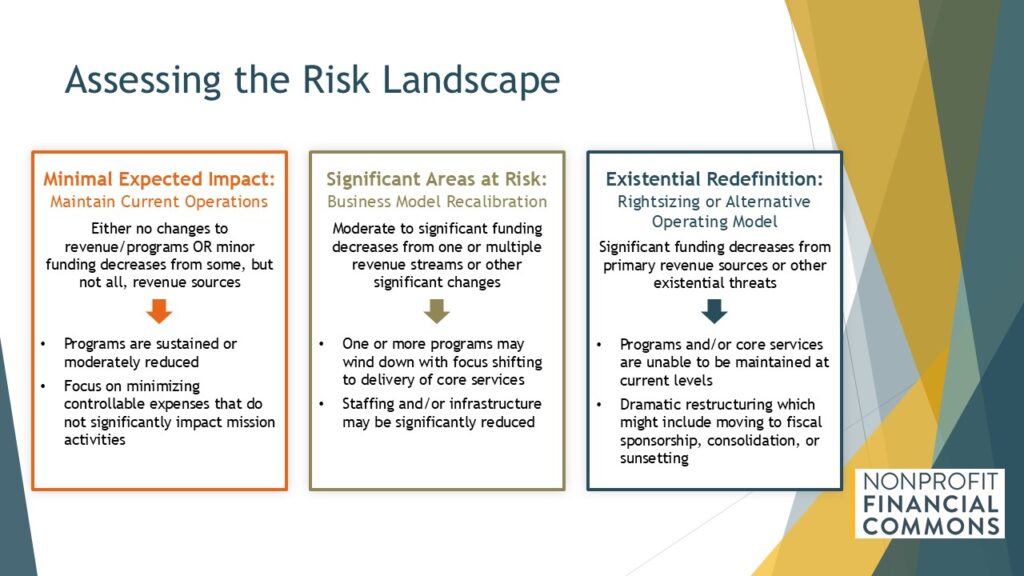

The answers to these questions should lead you to place your organization in one of the following categories of risk: Minimal Expected Impact, Significant Areas at Risk, and Existential Redefinition.

It’s possible to find yourself quickly moving from one category of risk to the next as new threats, challenges, and areas of uncertainty emerge.

Minimal Expected Impact

Organizations experiencing minimal expected impact can expect to maintain their current operations. These organizations anticipate no changes to their revenue levels or only minor funding decreases from some revenue sources, while other revenue sources hold steady or even increase. These organizations can likely sustain programs in their current configuration or implement only moderate reductions. At this end of the risk spectrum, organizations might focus on minimizing controllable expenses that do not significantly impact staffing or mission, such as negotiating new terms on contracts with service providers or researching new suppliers to engage at better rates.

Significant Areas at Risk

Nonprofits that face moderate to significant funding decreases from one or multiple revenue streams, or see other significant changes like partner program cancellation, will need to consider a business model recalibration. For these organizations, it may be time to wind down one or more programs and shift focus to the delivery of core services. This shift can mean significant reductions to infrastructure and/or staffing. As these changes are likely to have a greater impact on the nonprofit, leaders should be thoughtful in engaging diverse stakeholders in discussions about organizational values and non- negotiables before making any decisions. Leaders of organizations in this category should also have a clear understanding of the financial resources available to them — e.g., Liquid Unrestricted Net Assets (LUNA) or reserves — and how long those reserves can support operations. If the organization has been diligent in setting aside funds for a rainy day, this is the time to tap those resources.

Nonprofits in this category may also want to conduct a deeper analysis to understand if significant cost savings can be realized prior to reducing program services or tapping reserves. There may be back-office solutions that could result in meaningful savings, including outsourcing human resources and finance tasks, moving to a Professional Employer Organization (PEO) to reduce benefits costs, or engaging a Management Service Organization (MSO) to take over all back-office functions.

Existential Redefinition

Organizations facing significant funding decreases from their primary revenue sources or other existential threats to their sustainability may have to pursue an alternative operating model. This could take a variety of forms. Some options include significantly restructuring, suspending, or permanently eliminating programs. In some cases, there may be other organizations that are in a better position to absorb and sustain these programs.

For organizations whose work may be controversial, there is also the option to lean into the controversy with the hope of activating support from donors who might not otherwise be aware of the organization’s mission. This is a high-risk endeavor, however, and should only be undertaken with the full support of stakeholders and care for all who might be affected if support does not materialize.

Organizations facing existential redefinition will likely confront painful compromises that may pit their values against their sustainability. As a result, some leaders may close down their organizations and transfer all appropriate assets to another organization or community, which will require a formal approval process. Closure should not be considered failure. It can open up new opportunities for the organization in the future. In these cases, organizations should be good stewards of their assets, both tangible and intangible.

The Path Forward

This framework is not meant to guide a “one and done” decision. The nonprofit landscape has always been dynamic, requiring adaptability and creativity. As new challenges emerge, leaders should expect their organizations to move along this risk spectrum either by virtue of outside change or by internal demand. Those who recognize that risk need not be synonymous with threat will be best-positioned for capitalizing on new growth opportunities and responding to stakeholder needs when they arise.

While the business models the nonprofit sector has historically employed may be undergoing significant change, understanding your organization’s current financial situation remains critical to determining the path forward. By calibrating future plans to your risks, you can make thoughtful decisions about your organization’s strategy with the goal of preserving critical services and cultural enrichment for the communities you serve.