Nonprofit Legal Concerns – Webinar Recording and Resources List

Using the Law to Protect Nonprofits’ Missions and Finances:

An Empowered Approach

Video:

Accompanying Slides: Download here.

Transcript: Coming Soon.

The Nonprofit Financial Commons took a careful approach to this webinar on the legal environment where nonprofits find themselves in 2025. As we put it together, we wanted to make it clear that there are potential costs in misunderstanding the law. Not only could you inadvertently break the law, but you are also likely to curtail some mission-related activity because you fear breaking the law. There are times when following the law may be the wrong thing to do, placing you on the wrong side of history and alienating you from your constituency — or those in whose name you do business.

Why — and how — does this become a financial issue?

Your constituency is your reason for existing, and if they feel like you are not representing them as courageously as the times require, they will lose interest in you and stop supporting you in the innumerable ways that nonprofits need support from their base. This is social capital suicide in many cases, but the calculations around when to do and say what in these kinds of times can be excruciatingly difficult. That is why we lead with this reading on our responsibility to challenge unjust laws from Amnesty International and then move along to other resources:

Amnesty International’s Civil Disobedience Toolkit

This toolkit is aimed at organizations who are contemplating the use of civil disobedience. It sets out key principles when engaging in civil disobedience and the steps to use civil disobedience effectively, including planning, risk assessment, decision-making, implementation and evaluation. It also provides guidance on when and how to engage in acts of civil disobedience in a way that maintains the organization’s duty of care to those acting on its calls for civil disobedience and mitigates reputational, financial, legal and other risks. Download the toolkit here.

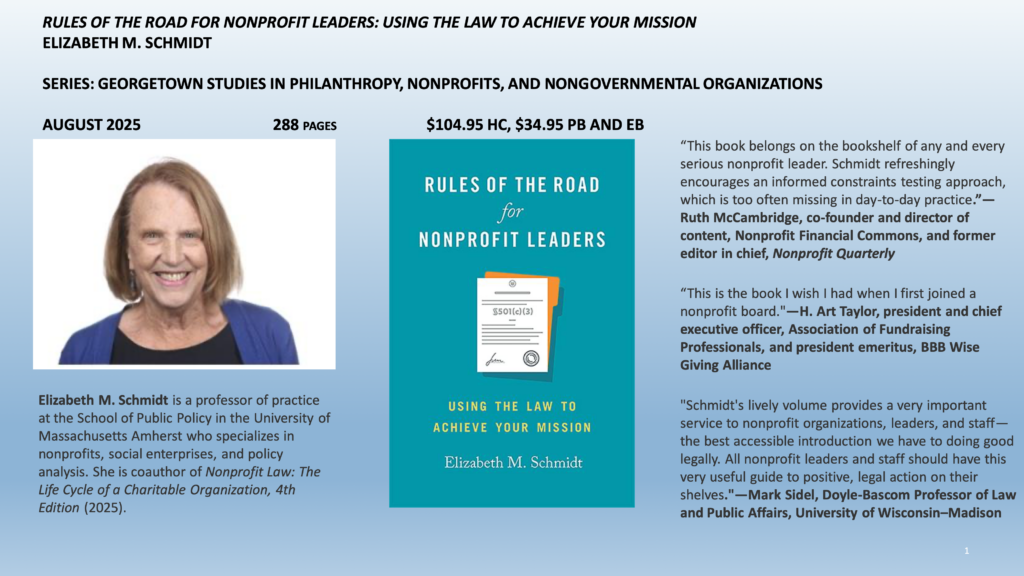

And we’ll follow that with a new, must-have reference publication on nonprofit legal issues that’s coming this summer:

Websites and Blogs That May Interest You

General Nonprofit Law

- Ellis Carter publishes the CharityLawyer blog, which offers information about a variety of topics relevant to tax-exempt, non-profit, and mission-based businesses, as well as major donors and companies engaged in cause marketing. Visit the blog here.

- The NEO Law Group’s Nonprofit Law Blog does similar work. Visit the blog here.

The Trump Era and Nonprofits

Chronicle of Philanthropy

- Nonprofits and the Trump Agenda: A selection of key reporting and opinion pieces on the second Trump administration and what it means for the nonprofit world.

- “Seeking Rapid Response Grants? These Funds Are Offering Help.” Stephanie Beasley collates and curates a list of foundations offering emergency support to nonprofits facing cuts in federal grants.

National Council of Nonprofits

- Executive Orders Affecting Nonprofits

- Executive Actions Impacting Nonprofits: General FAQs

- Communications Guide (talking points and messaging frameworks)

Information on Specific Areas of Nonprofit Law

- FAQs for Recipients of Federal Funding Regarding Required Certifications: Recently, many nonprofits that receive federal funding have been told that, in order to continue receiving federal funds, they must certify that they comply with the executive orders or with federal anti-discrimination laws. This legal alert from the Lawyers Alliance for New York explains the current state of litigation around the certification requirements and lays out some practical steps a nonprofit can take to reduce organizational risk around signing such a certification. Read it here.

- Bolder Advocacy: The Alliance for Justice’s program to build grassroots power by equipping nonprofits with the tools, training, and resources to advance their missions through policy advocacy. Read more.

- The National Council of Nonprofits offers this checklist of what to do when your federal grant or contract is terminated.

- Evolving Threats to the Tax-Exempt Status of 501(c)(3) Nonprofits: This briefing document from the International Center for Not-for-Profit Law focuses on three avenues by which 501(c)(3) nonprofits can lose their tax-exempt status: illegal purpose or activities, activity contrary to fundamental public policy, and support for terrorism. It analyzes measures in place to prevent politicized investigations by the IRS and steps nonprofits can take to protect themselves. Read it here.

- Nonprofits Under Fire: How the IRS Can — and Cannot — Revoke Federal Tax-Exempt Status: Jeffrey S. Tenenbaum, writing for his law firm’s blog in April 2025, observes that “There simply is no lawful mechanism for the President, IRS, or others in the Trump administration to revoke the tax-exempt status of multiple nonprofits – or even a single nonprofit – without following this longstanding process.” Read on for more detail.

A Partial List of Paperwork to Remember

Documents states require (Requirements vary by state, and don’t forget local forms)

- Articles of incorporation or their equivalent

- It’s good practice to examine every few years for purpose clause and agent’s name

- Corporate registration and/or registration as foreign agent

- Annual corporate reports

- Charitable solicitation registration (annual)

- See National Association of State Charity Officials, State Charity Registration Provisions (Oct. 7, 2022) for a list of state requirements.

- State tax documents

- See Harbor Compliance, 50-State Chart of Nonprofit State Tax Exemptions

- See if your state has a list of required forms, e.g., California Compliance Checklist

- Often publicly disclosed. Must always be accurate and timely.

Documents the IRS requires

- Form 1023 for 501(c)(3)s

- Form 990. Different form, depending on size

- Publicly disclosed—must be accurate and timely

Governance documents (Not publicly disclosed, but they are important and must be completed & followed)

- Bylaws

- Policies

- Minutes

Financial records

- Need careful records!

- Special attention to restricted funds

- Some states require audits of large nonprofits

- Be sure to pay withholding taxes! Board members can be personally liable if they are not paid!

Risk management

- Insurance!