A Three-Dimensional Approach to Revenue Planning

By Flannery Berg and Hilda Polanco

This is the second in a series of articles responding to the 2025 turbulence in the nonprofit financial revenue landscape.

EXCLUSIVE TO THE NONPROFIT FINANCIAL COMMONS — MARCH 2025

While most nonprofits would prefer revenue that is largely reliable and renewable, having too much of it that’s dependent on too few sources is a dangerous proposition and can give a false sense of security. Still, although fund diversification has long been touted as important to the sustainability (if not rapid growth) of nonprofits, this article suggests that two other dimensions must be measured to achieve financial health over time. These are predictability (sometimes called reliability) and flexibility (sometimes understood as autonomy). As many nonprofits reimagine their future budgets, it’s important for boards and staff to use three-dimensional thinking that balances diversity, flexibility, and reliability.

Revenue mix, and specifically the diversity of revenue across types and sources, is often cited in boardrooms and foundation offices across the nonprofit sector as the key to financial sustainability and risk mitigation. Indeed, diversification as a strategy has taken on increased prominence and urgency in 2025, as government funding sources have become less predictable for many organizations who may have relied on them as part of their baseline assumptions.

And diversification can be an effective strategy to reduce the risk of being dependent on a certain source of revenue, particularly if there is a concern around renewability or instability of that support. Nonetheless, pursuing diversification for its own sake can itself be a risky endeavor. Expanding into a new revenue stream requires a significant investment in the infrastructure, skills, and capacity to effectively manage and grow that income source. Seeing results from that investment may take longer than leaders expect.

Two additional aspects of revenue — flexibility and predictability — can provide nonprofit leaders with a stronger framework from which to understand and manage their business model risk.

Flexibility

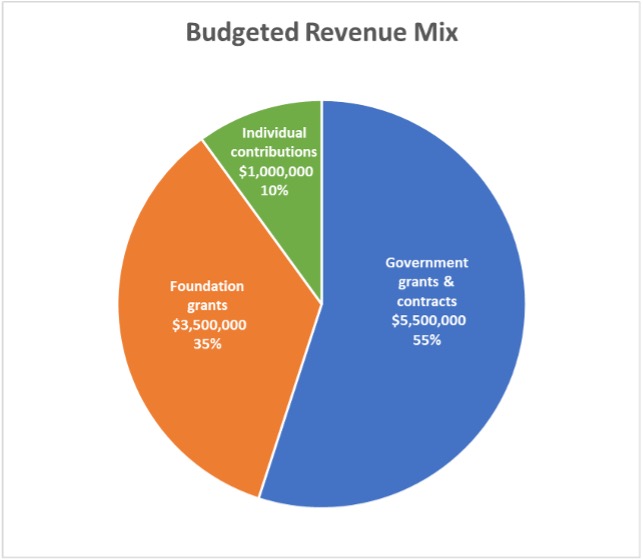

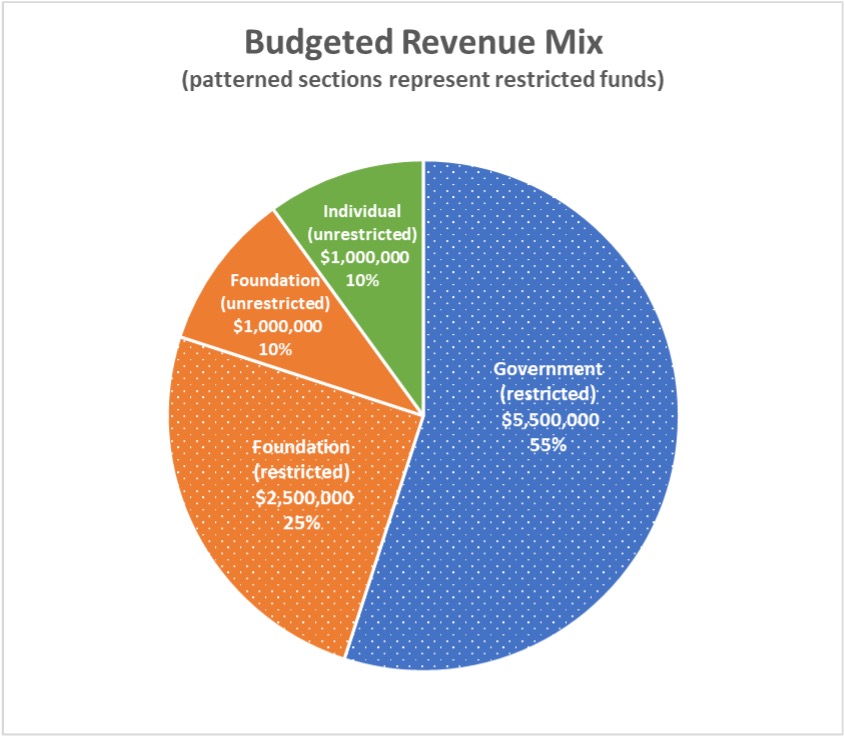

Flexibility is an indicator of how much of an organization’s revenue is available for immediate, general use — or, on the flip side, how much is restricted by donors to specific purposes or time periods. Take, for example, an organization budgeting $10 million in revenue for the upcoming fiscal year from a mix of government, foundation, and individual sources, as shown in the Revenue Mix graph. From a revenue diversification perspective, the organization has achieved what may appear as a healthy, diversified mix of government (55%) and non-government (45%) sources; however, this organization still finds itself struggling to cover costs and facing dwindling reserves.

When we look at revenue flexibility, or how much of its revenue is unrestricted, we understand why. Because most of its foundation funding as well as its government funding is restricted, only 20% of its revenue is available for use purely at its leaders’ discretion. The organization is limited in how it can cover overhead expenses and program costs not covered by grants, let alone grow reserves by setting aside resources for the future.

Of course, it is often easier to raise restricted dollars than to generate purely unrestricted support, and restricted grants can play a large role in driving program outcomes. However, when an organization finds that its unrestricted sources are just barely covering overhead expenses — or worse yet, not covering them — it may be time to examine revenue strategy closely. For many organizations, this pivotal moment may be when it finds that more than 70% of its funding is restricted.

In those cases, leadership must carefully consider the following:

- Do our restricted grants cover full costs of the activities those grants are funding, including both direct program costs and indirect expenses? If not, do we have sufficient unrestricted dollars to subsidize program costs and cover overheard costs?

- How flexible are our restricted grants? Are we operating within strict, line-item restricted grants, or do we have flexible program funding to spend as needed for our programs?

- If our revenue is becoming less flexible over time, do we have operating reserves or Liquid Unrestricted Net Assets (LUNA) to provide liquidity and security? Are these reserves adequate for our planned growth?

Predictability

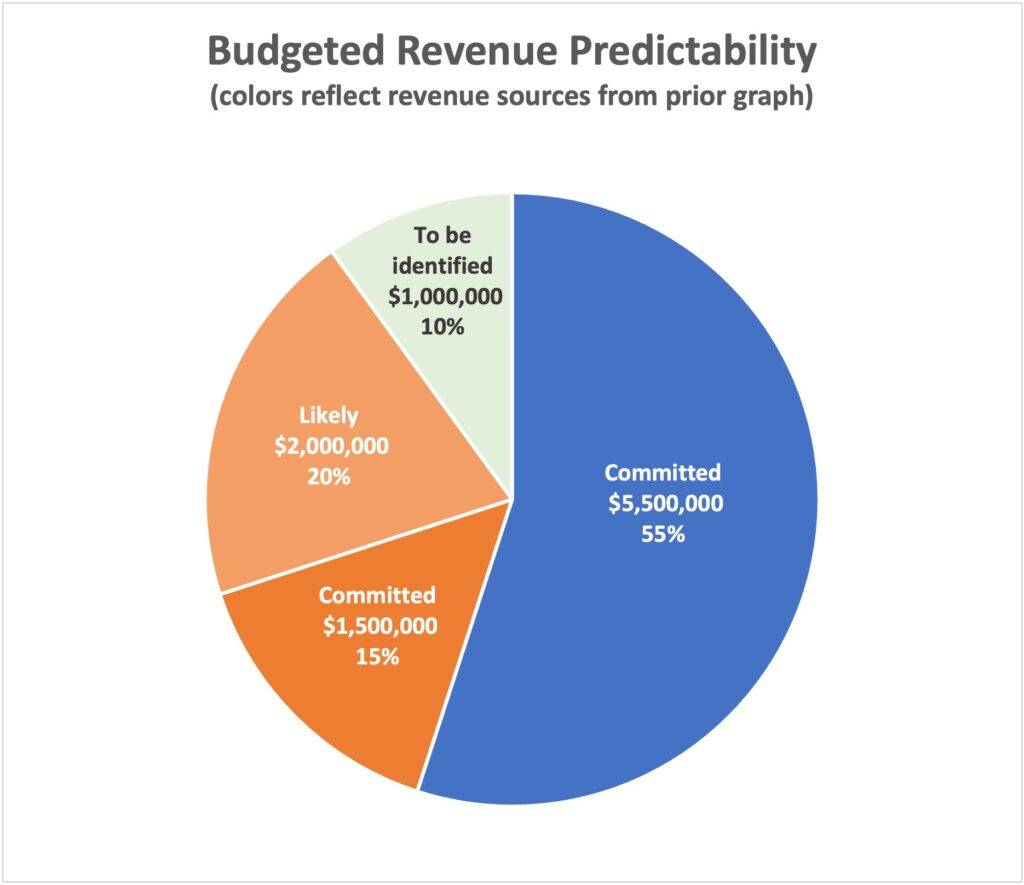

In addition to flexibility, layering in an analysis of predictability — or the level of certainty of receiving revenue in current and future years — can round out our picture of revenue risk. While our hypothetical organization may not have much flexibility in its revenue mix, it benefits from having more predictability. As shown in the graph below, the organization needs to identify sources for just 10% of its budgeted revenue (representing its individual contributors), whereas 70% is already committed (including its government grants and $1.5 million of its foundation funding) and an additional 20% has been classified as from likely prospects (additional foundation funders).

For some organizations, a budget in which 30% of revenue is uncertain may feel risky. Determining your organization’s risk tolerance when it comes to including uncommitted sources is a key first step and one that should be informed by past trends (such as track record of fundraising performance) along with future forecasts.

To provide this type of analysis for the budget, a strong fundraising team will evaluate their revenue sources and prospects based on probability. How organizations integrate this type of analysis into their budgeting varies. Some organizations may only include committed and likely sources, while others may include sources yet to be identified. Other organizations may choose to develop conservative and stretch budgets that reflect different scenarios of revenue. Regardless, board and staff leadership should have clarity about how much of their budgeted revenue comes from committed sources and their risk tolerance related to including uncommitted sources.

Diversification has long been touted as the key to nonprofit revenue planning, but it is an incomplete strategy for mitigating revenue risk. By taking a three-dimensional approach to revenue planning that integrates flexibility and predictability, nonprofit leaders can navigate from a more complete map of their revenue risk. Sector leaders, from board members to funders and consultants, should strongly consider this approach when supporting and advising nonprofits to avoid the shortcomings of promoting diversification alone as a driving strategy.